Tag: rural property and business

Land and Property Professionals

We sell, rent, manage, survey, plan and advise...what can we do for you?

We sell, rent, manage, survey, plan and advise...what can we do for you?

In 2018, the Government began to undertake consultations regarding the use of exemption licences at permitted waste sites, with the aim of improving operator competence standards at such sites and reducing the use of the exemptions to cover illegal activity. The consultations raised a series of amendments to be made to the key exemptions that were deemed to encourage poor environmental practice or illegal activity. The proposed reforms make changes to storage limits on waste, the waste that can be used for specific exemptions and to remove some exemptions all together.

Some reforms have already been implemented, such as disallowing multiple exemption licences to be applied for on one site. Further reform on waste records now requires waste operators (i.e. those with a waste exemption licence or environmental permit) to keep electronic records of storage and movement and to provide these on demand.

The new reforms are proposed to come into force in autumn 2024, although a formal date has not yet been released. Each exemption has a specific transition period, setting a period in the months following the reform implementation by which waste operators must conform with the changes. The transition period applies to existing licences and licences registered in the transition period. For those exemptions that are due to be removed, waste operators will be required to apply for an environmental permit to continue these activities.

The table below details the changes to the individual exemptions:

| Exemption | Reform | Transition Period (months) |

| U1 – Use of Waste in Construction | Change to waste codes Name change | 12 |

| U16 – Using Depolluted End-of-Life Vehicles for Parts | Removal of exemption | 3 |

| T4 – Preparatory Treatment of Waste by Baling, Sorting, Shredding, Pulverising, Densifying, Crushing, Granulating or Compacting It | Change to storage conditions Name change | 6 |

| T6 – Treatment of Waste Wood and Waste Plant Matter by Chipping, Shredding, Cutting or Pulverising | Change to storage conditions Name change | 6 |

| T8 – Mechanically Treating End-of-Life Tyres | Removal of exemption | 3 |

| T9 – Recovering Scrap Metal | Removal of exemption | 3 |

| T11 – Repairing or Refurbishing Waste Electrical and Electronic Equipment | Additional fee for licence | N/A |

| T12 – Manually Treating Waste | Changes to storage conditions | 6 |

| T21 – Recover Waste at Waste Water Treatment Works | Change to waste codes | N/A |

| D7 – Burning Waste in the Open | Change to waste codes Name change | 12 |

| S1 – Store Waste in Secure Containers | Change to storage conditions Change to waste codes | 12 |

| S2 – Temporary Storage of Waste at a Secure Site Pending Recovery Elsewhere | Change to storage conditions Change to waste codes | 12 |

| S3 – Storing Sludge | Change to volume of waste required for exemption | N/A |

For further information on the waste exemption regulation reforms, please contact Emily.

The latest version of the Sustainable Farming Incentive (SFI 2023) opened for applications from Monday 18th September 2023.

Since the end of August, farmers have been asked to ‘express their interest’ in entering the scheme. Those who did so will be contacted by the Rural Payments Agency and invited to make a full application. This is to be a stepped and controlled invitation process, with farmers not invited into the scheme all at once. Currently, an application can only be made once this initial invitation has been made.

Farmers who are interested in applying are to ensure that all required information is correct, to include online maps and land use / cover details. This will allow the online system to outline which SFI 2023 options can be chosen at the time of applying.

The Department for Environment, Food & Rural Affairs has also confirmed that farmers who have a live SFI 2023 agreement in place by the end of the year will receive an accelerated payment, being 25% the value of their agreement, in the first month of their agreement. This is to help with cashflow, in recognition of the reductions in other funding and the delay in the implementation of this scheme. Please note, standard payments for this scheme are due to be paid quarterly.

For more information or to discuss any of the above, please contact a member of our Rural Team.

Countryside Stewardship

The Department for Environment, Food and Rural Affairs (Defra) has announced that some of the Countryside Stewardship revenue payment rates have increased with effect from 1st January 2023. Where applicable, the higher revenue payment rate will be for both applications received in 2023, as well as revenue agreements which started on or before 1st January 2023.

Payment rates for capital Countryside Stewardship items have also been updated in line with current costs. The increased payment rates only apply to agreements which start 1st January 2023 onwards but there is the option to withdraw capital items from earlier schemes and reapply. Farmers will now have three years to complete and claim for capital works rather than two. Applications for new Capital Grant only schemes can now be made all year round so anyone considering applying should start looking at the application process.

Both Countryside Stewardship Mid-Tier and Higher-Tier Schemes will continue to be offered to applicants for agreements starting on 1st January 2024, with applications opening February/March 2023. It has also been announced that Defra will replace the proposed Local Nature Recovery Scheme with an enhanced Countryside Stewardship Scheme. This scheme will be known as Countryside Stewardship Plus and will provide payments in relation to carbon and biodiversity. Further details are yet to be released, but there are likely to be up to around 30 additional actions available to farmers under this new scheme by the end of 2024.

Sustainable Farming Incentive

2022 saw the launch of the Sustainable Farming Incentive (SFI) Scheme, with land managers able to apply to enter their land into three standards, being Arable & Horticultural Soils, Improved Grassland Soils and Moorland.

In 2023, there will be new standards launched under SFI, as detailed below:

Additionally, a new SFI Management Payment is being introduced. This payment will be for £20 per hectare, for up to 50 hectares of land entered into the SFI scheme, so a maximum payment of £1,000. The payment is aimed towards encouraging smaller farms to take advantage of the financial incentives that SFI could provide. This management payment will not be offered to those who already participate in the SFI pilot programme. Currently, there are no further details as to when the Management Payment will be applied or available.

Landscape Recovery

The Landscape Recovery Scheme falls under the umbrella of Environmental Land Management Schemes (ELMS) and is for large scale projects which look to undertake significant habitat restoration and land use change. The first round of applications has now closed but there will be a second round of applications opening later this year.

Innovation and Productivity Grants

It is expected that the next round of the Farm Equipment and Technology Fund, for small grants between £2,000 and £25,000, will be launched in spring 2023.

These latest announcements made by Defra provide much of the information we’ve been waiting for to allow farmers to plan future schemes, although there are still further details to be announced. We’d encourage all farmers to look at the various schemes and consider which work best for their farm to ensure opportunities are not missed.

If you would like one of our team to undertake a review please do get in touch. For more information or to find out how our Rural Property & Business department can help you please contact 01234 352201 or 01280 428010 or email bedford@robinsonandhall.co.uk

The Department for Environment, Food and Rural Affairs (DEFRA) has announced further details regarding the plans to replace the Basic Payment Scheme (BPS) in England with delinked payments. Currently, there is a defined plan for the phasing out of BPS payments to 2024, at which point the payments made to farmers will be approximately half of the payment received prior to phasing out.

The delinked payments, from 2024 to 2027, will be calculated on the average of the BPS payments made to a business in a reference period, 2020-2022, and then reduced based on the size of the claim as they are gradually phased out with the last payment made in 2027.

The delinked payments will not be affected by changes in farm size, nor if the land use of the holding is changed after BPS 2022. Following BPS 2023, entitlements will be cancelled to a nil value.

If there have been changes to a business since the start of the reference period (being BPS 2020), this could affect the amount of the delinked payment received.

Lump Sum Exit Scheme

The Lump Sum Exit Scheme (LSES) will provide BPS applicants who wish to leave farming with an opportunity to do so in a planned way. The scheme makes an up-front payment of a farmer’s future BPS payments so long as they surrender their entitlements and transfer out their land.

In order to be eligible for the scheme, applicants must have either:

In order to receive the lump sum payment, applicants must apply this year and then by 31st May 2024 must:

Applicants will still be able to work as a contractor or work for other farmers once they have received the lump sum payment.

A sole trader cannot transfer land to a spouse/civil partner, or to someone with whom they are cohabiting as a couple.

If a farmer decides to take the lump sum payment, they will no longer be eligible for BPS payments or delinked payments. Similarly, it is unlikely that a farmer will be able to meet the rules of other schemes, such as Countryside Stewardship or Sustainable Farming Incentive, if they have taken the lump sum payment.

The LSES reference amount is calculated by the average of a business’s BPS payments received in 2019, 2020 and 2021. This amount is then multiplied by 2.35 and this will be the lump sum available for each business. The reference amount will be capped at £42,500 meaning a total cap on the LSES payment of just under £100,000.

LSES applications will be open from April to September 2022. This is a one-off, non-competitive scheme, and all applicants must transfer out their agricultural land and provide evidence of this by 31st May 2024. If applicants wish to enter their agricultural land into woodland creation schemes instead of transferring it, they must be accepted into the scheme and have planted the trees by 31st May 2024.

There are a number of considerations for a business thinking about taking the LSES and therefore we would encourage people who feel it could be of interest to consider the scheme early as the application window is relatively short.

For more information or to find out how our Rural Property & Business department can help you please contact 01234 352201 or 01280 428010 or email bedford@robinsonandhall.co.uk

With the end of 2021 fast approaching, the Department for Environment, Food and Rural Affairs (Defra) have finally provided details of the Sustainable Farming Incentive (SFI) early rollout, due to occur in spring 2022. The proposed rollout, the first element of the Environmental Land Management Schemes, is a slimmed-down version of the Sustainable Farming Incentive Pilot, the agreements of which are currently being implemented.

The SFI early rollout (SFI 2022) has seen amendments to the initial concept of the scheme, with policymakers listening to applicants’ and experts’ thoughts on the practicalities of operation. The agreements will last 3 years, with payments made quarterly. There will be no minimum or maximum land areas and applicants will be able to choose the specific land parcels included in the agreement. There will also be an element of flexibility to amend the agreement every 12 months – such as including additional land areas.

As with the SFI Pilot, the SFI 2022 requires applicants to enter land parcels into ‘Standards’, being:

The first two Soil Standards will be the focus for most applicants. These Standards will only have introductory and intermediate levels to start with. As with the SFI Pilot, the payment received is reflective of the level of Standard that is entered into.

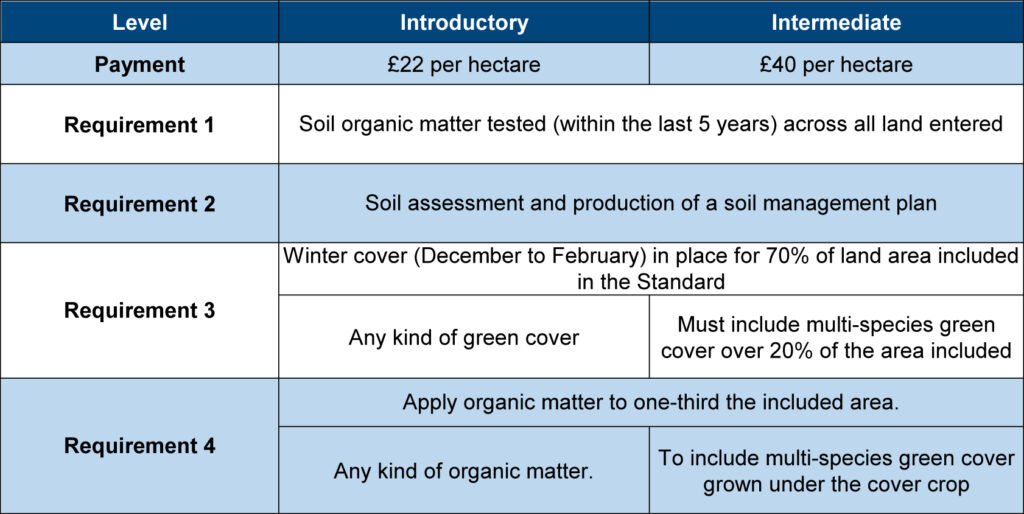

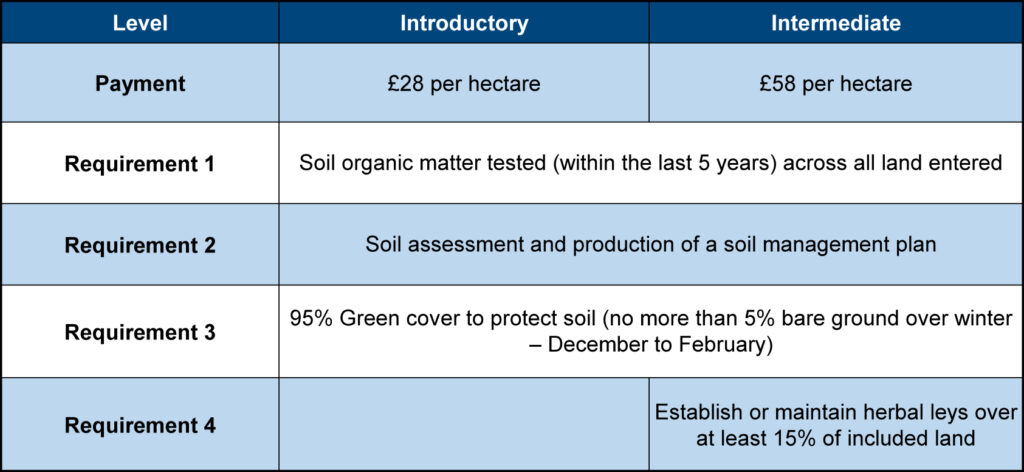

A summary of the requirements and the related payments, per hectare, are summarized below:

Arable and Horticultural Soils Standard

Grassland Soils Standard

The advanced levels for both Standards are expected to be introduced from 2023. We have been told the Advanced Arable and Horticultural Soils Standard will focus on no-till and min-till farming.

Effort has been made to keep the Standards, and levels, as simple as possible to encourage implementation on the ground. However, there are specific nuances to several of the requirements, e.g. time requirements for the testing of soil organic matter. It is recommended that the full scheme is reviewed and considered in advance of the application window, which will be 10 weeks, opening in spring 2022.

The full scheme manual can be found at:

Sustainable Farming Incentive: how the scheme will work in 2022 – GOV.UK

If you would like more information or to discuss the options available, please contact a member of our Rural Team.

Over the last three years, we have seen a growing trend of landowners being approached by developers looking to develop new garden villages. These garden villages are often within the open countryside on land that we would not normally consider suitable for development as it is not adjoining any major settlement.

The garden village concept is for these communities to be self-servicing, with a local service centre, and to vary between 1,000 and 3,000 houses. The area of land required is significant at 200 to 600 acres per village and we have noticed a trend towards being close to a train station and/or good road connection.

The garden village concept therefore offers huge opportunities to landowners to gain the benefit of development proceeds, whilst also creating a development that they can be proud of with a focus on place making and designed with the community in mind.

The first few developments using this new concept have now received planning permission and the house builders, in particular the large PLCs, like the concept due to them being able to provide a significant housing number over the long term. The advantage to the local councils is that it provides the opportunity to locate housing away from further expansion on the edges of existing conurbations.

With the continued need for new housing sites and the Government preparing its Strategic Framework for the Oxford to Cambridge Arc, we are already involved in negotiations for a significant number of garden village sites and expect to see further proposals come forward through the planning system.

If you are a landowner and are approached about a new garden village development, please do consider it carefully and discuss it with us at an early stage. The development of such land may feel farfetched but it may now be far more likely than it once was.

Should you have any questions then please contact Andrew Jenkinson, Partner and Rural Chartered Surveyor, on 07967 964508 or email abrj@robinsonandhall.co.uk

The Government has launched a consultation on the Oxford to Cambridge Arc which is aimed to inform their approach and vision to the future of the Arc. The consultation will run for 12 weeks from 20th July to 12th October 2021.

The Spatial Framework, which will be produced over the next two years, will set out the master vision for the Arc and will have the same weight in planning terms as the National Planning Policy Framework. This means that all of the Local Planning Authorities within the Arc will have to comply with this document when drawing up their own individual local planning policy.

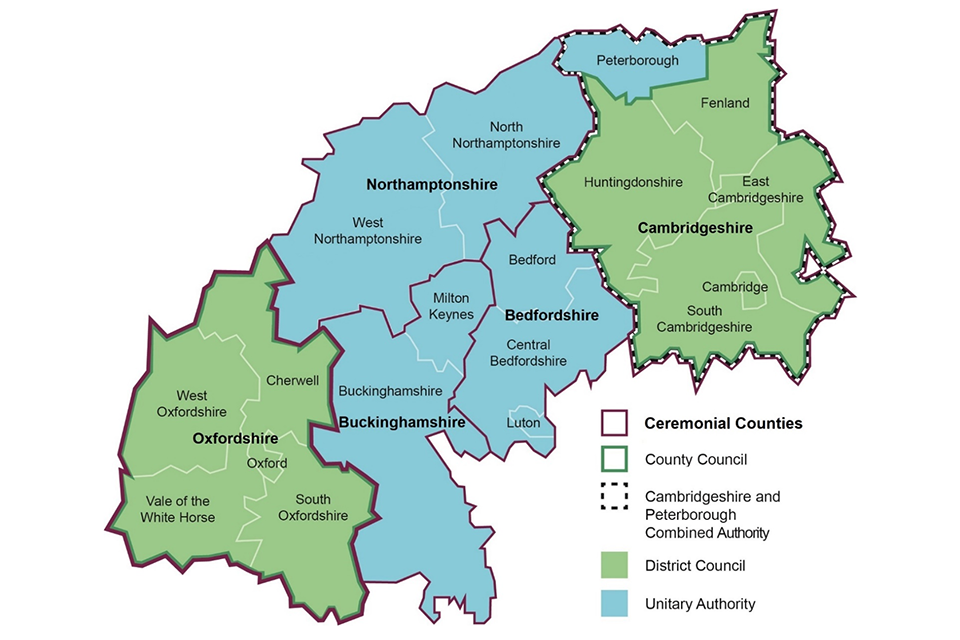

The consultation covers the counties of Oxfordshire, Buckinghamshire, Northamptonshire, Bedfordshire and Cambridgeshire and is the first of three consultations. Whilst the final Spatial Framework will not make site allocations, it will recommend areas for growth and will guide the Local Plans and investment decisions through to 2050.

The Government believes that the Spatial Framework will allow them to plan for growth in a way that:

environment and beautiful places; and

In addition, the Government has announced a new expert panel to advise on sustainable economic and housing growth in the Arc. The panel’s primary area of focus is between Bedford and Cambridge where the Government is examining opportunities to bring forward well designed, inclusive and sustainable places.

It is important to make your voice heard in the preparation of the Spatial Framework, as it will guide many planning decisions over the next 20 years, even with changes in central and local Government. Please click here to have your say on the Oxford to Cambridge Arc. The link will take you to the online platform with set consultation questions.

If you require more information on the Oxford to Cambridge Arc, please visit the Government website here. If you would like to speak to one of our Rural Property & Business experts about the Oxford to Cambridge Arc and potential impacts it could have on your land, please call 01234 352201 and ask to speak to Andrew Jenkinson or Polly Sewell.

The Forest of Marston Vale Trust has secured unprecedented levels of funding from the Department for Environment Food & Rural Affairs (Defra) to accelerate tree planting activity within the Marston Vale area of Bedfordshire over the next four years. Under this new “Trees for Climate” scheme, up to £8 million is available to support new tree planting projects up until April 2025. It presents an excellent opportunity for landowners looking at options for their land going forwards, and a chance to explore how trees can be part of their plans.

Covering 61 square miles between Bedford and Milton Keynes, as shown in the plan below, the Forest of Marston Vale is one of 12 Community Forests established during the early 1990s. Since its inception over 2 million trees have been planted within the Forest area and, with the Government’s commitment to planting 30,000 hectares of woodland per year across the UK by 2025, this additional funding will help enable more planting to be completed.

The Defra-backed Trees for Climate Scheme will provide flexible funding packages to landowners for creating new woodlands, including payments for up to 15 years. Assistance will be given to design planting proposals and also to plant and establish the new woodland over the first 5 years, if required. Locally, the Trees for Climate scheme is unique to the Forest of Marston Vale, and offers more flexible and potentially greater levels of funding than nationwide schemes recently launched by the Forestry Commission.

If you have land within the Forest of Marston Vale area and would like more information on the Trees for Climate Scheme, please contact Katie Cross on 01234 362935 or email krc@robinsonandhall.co.uk