Category: Rural Property & Business

Land and Property Professionals

We sell, rent, manage, survey, plan and advise...what can we do for you?

We sell, rent, manage, survey, plan and advise...what can we do for you?

The Department for Environment, Food & Rural Affairs (DEFRA) has now published its consultation on the proposed changes to the Basic Payment Scheme (BPS) and future funding for farmers. This includes its proposals for a lump sum exit scheme and the approach to delinked payments in England post-2023. It includes details of potential eligibility criteria, how the lump sum is calculated and the reference period to be used for determining both the lump sum payment and the value of delinked payments. The main points of the consultation are summarised below:

Lump Sum Exit Scheme

DEFRA plans to offer farmers in England who want to exit the agricultural industry the opportunity to do so by offering a lump sum payment. It is proposed that this lump sum will be offered in 2022 only and will create early opportunities for new entrants to access the industry.

If a farmer chooses to take the lump sum payment, all English BPS entitlements held by them will be cancelled, with no option for taking a partial lump sum. To be eligible for the lump sum scheme, a farmer would have to give up their land in England either by gift, sale or letting for a term of at least 5 years. To prevent recent entrants from applying for the lump sum payment, eligible applicants must have first claimed direct payments in 2015 or earlier. Additionally, free entitlements for young and new farmers will cease.

It is proposed that the lump sum payment will be calculated using an average of the values of BPS payments made to a farmer during 2018, 2019 and 2020. The lump sum payment will be calculated at 2.35 times the reference amount, with a proposed payment cap of £100,000.

DEFRA is aiming to provide the key rules and guidance for the lump sum payment by the end of October 2021 in advance of the introduction of the scheme in 2022. It is anticipated that the application period for the lump sum exit scheme will be in the first half of 2022.

Delinked Payments

DEFRA intends to introduce delinked payments in 2024. This means that recipients of BPS will no longer need to farm the land to receive the payment. The eligibility for delinked payments will, similarly to the lump sum payment scheme, be based on a reference period. In order to receive the delinked payments, it will be necessary for the recipient to still be farming at the end of the reference period and in 2023 if the reference period is earlier than this. New entrants who enter farming after the reference period will not be eligible for delinked payments but will be able to apply for payments through any newly available schemes, such as the Environmental Land Management Scheme (ELMS).

The value of the delinked payments between 2024 to 2027 will be calculated based on the BPS payments made to the farmer in a reference period, by using a ‘reference amount’ for each applicant. DEFRA is currently proposing some potential dates to use for the reference period, the first being 2018, 2019 and 2020 as per the lump sum payment scheme. The second option is to use the average of the 2018 to 2022 payments and the third is just the 2022 payment. The reference period used to calculate the delinked payments will be confirmed following the consultation. Additionally, DEFRA will inform farmers of their reference amount prior to making the delinked payments in 2024. This has an immediate impact on those who are looking to rent or buy land as the reference period chosen will effect your level of payments between 2024 and 2027.

The consultation period commenced on 19th May 2021 and will end at midnight on 11th August 2021. Anyone wishing to respond to the consultation can do so via the following link: https://consult.defra.gov.uk/agricultural-policy/lump-sum-and-delinked-payments-england. Alternatively, responses can be made by email to DirectPaymentsConsultation@defra.gov.uk or by post: Direct Payments Consultation, Consultation Coordinator, Defra, 2nd Floor, Foss House, Kings Pool, 1-2 Peasholme Green, York YO1 7PX.

For further information please contact our Rural Property & Business team on 01234 352201.

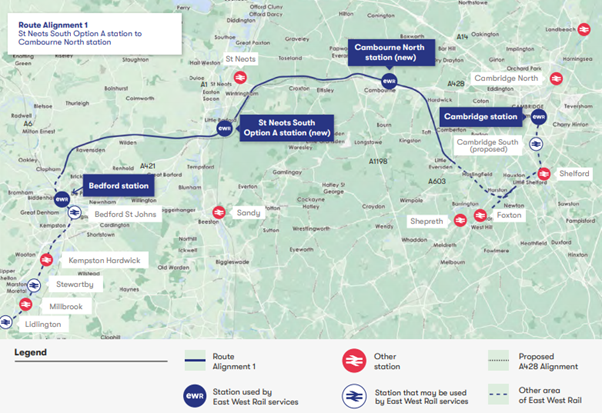

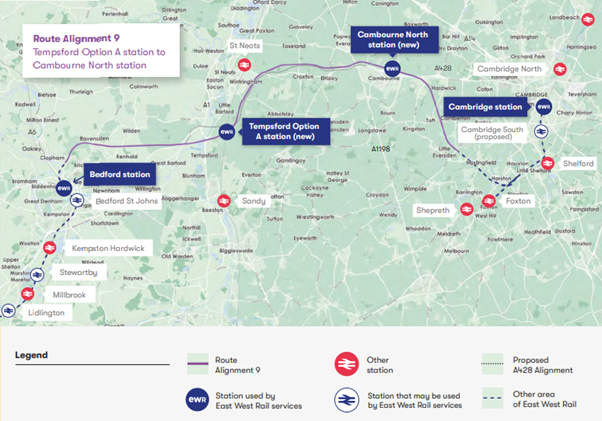

With a number of clients affected by the proposed corridor for East West Rail we have been awaiting more news of the proposed route. We have today received information of a consultation on five possible routes for the line between Bedford and Cambridge. The consultation also includes details of planned changes on the Milton Keynes to Bedford route.

On the Bedford to Cambridge sections, we understand that nine initial routes have been narrowed down to five and these will now undergo public consultation. Routes 1 and 9 are currently considered the most favourable. The consultation is now open and runs until 9th June 2021.

The five possible routes are shown on the plan below:

The current preferred options are routes 1 and 9 and the plans below show these in more detail:

If you would like to respond to the consultation it can be found here: https://eastwestrail.co.uk/consultation

If your property is affected by the scheme and you would like further advice please contact Polly Sewell on 01234 362933 or email pkts@robinsonandhall.co.uk

We have seen an increase in the number of claims for new public rights of way based on historical evidence over recent months. Both the Ramblers Association, the British Horse Society (BHS) and other rights of way groups are encouraging members to identify previously unrecorded public rights of way. These routes will then be submitted to the relevant local authorities as Definitive Map Modification Order applications in the hope that they will be permanently added as public rights of way.

A deadline of 1st January 2026 has been set as the date by which any public rights of way which have not been formally registered on the Definitive Map will be lost and this has led to the recent increase in claims.

Members of the public can make claims to their local authority for a route to be recorded as a public right of way if there is evidence that a route existed historically. A claimant must provide evidence, usually historic maps, to prove their claim. This can apply if the route is no longer used by the public or even if the route itself no longer exists on the ground.

This project could potentially have a significant impact on landowners as the BHS are looking at hundreds of unrecorded routes. If their applications to modify the Definitive Map are successful, there will be many new registered public rights of way crossing landowners’ property.

How to object

Landowners looking to object to claims made will need to be able to demonstrate that the historic evidence produced by the claimant is inaccurate or unreliable. Alternatively, landowners can produce their own evidence showing that a route was not historically a right of way. There are deadlines for submitting objections and it is important that these are adhered to.

Whilst a deposit under Section 31(6) of the Highways Act 1980 is something we recommend for clients to prevent claims for new rights of way by the public using them continuously for at least 20 years, such a deposit cannot protect land from claims for historic routes.

For more information or to find out how our Rural Property & Business department can help you please contact 01234 352201 or email bedford@robinsonandhall.co.uk

The Department for Environment Food & Rural Affairs (Defra) has recently opened expressions of interest for a trial of the Sustainable Farming Incentive (SFI). It is intended that the SFI will be open to all Basic Payment Scheme claimants next year as the first step in the move towards the new Environmental Land Management Scheme (ELMS). Defra wants to trial parts of the SFI this year with several hundred farmers from different parts of the country and with different types and sizes of farms.

SFI will pay farmers for sustainable management practices above the regulatory baseline. There will be a number of standards from which farmers can choose actions which are best suited to their particular farm.

In the first phase of the pilot, farmers will choose from eight standards to build up an agreement. The standards and payments available under the first phase of the trial are as follows:

| Standard | Initial base rates (first phase of pilot only) |

| Arable and horticultural land standard | from £28 up to £74 per hectare |

| Arable and horticultural soils standard | from £30 up to £59 per hectare |

| Improved grassland standard | from £27 up to £97 per hectare |

| Improved grassland soils standard | from £6 up to £8 per hectare |

| Low and no input grassland standard | from £22 up to £110 per hectare |

| Hedgerow standard | from £16 up to £24 per 100 metres |

| On farm woodland standard | £49 per hectare |

| Waterbody buffering standard | from £16 up to £34 per 100 metres |

There will also be a participation payment made to all participants.

Within each standard in the pilot there will be three levels with increasing requirements and payments as you go up the levels. For example, under the Arable and Horticultural Land Standard, the actions and payments under each level are as follows:

| Introductory level (£28 per hectare) | Intermediate level (£54 per hectare). All actions in the introductory level plus | Advanced level (£74 per hectare). All actions in the introductory and intermediate levels plus |

| Provide year-round resources for farmland birds and insects | Improve nutrient use efficiency and reduce loses to the environment by carrying out a nutrient budget | Provide nesting and shelter for wildlife by having areas of tall vegetation and scrub |

| Better meet your soil requirements by following a nutrient management plan | Increase habitat for farm and aquatic wildlife through rotational ditch management | Benefit from crop pest predators by locating their habitats next to cropped areas |

| Minimise emissions of ammonia through rapid incorporation of organic manures and slurry on ploughed land | Better target your nutrient application by carrying out soil mapping | Use efficient precision application equipment for fertilisers and organic manures |

To be eligible for the trial, farmers must be claiming BPS and the pilot cannot be on parcels already in an agri-environment scheme (Higher Level Stewardship or Countryside Stewardship). They must have management control of the land until late 2024 and the land cannot be part of a common. Payments will be made monthly and those in the trial will still receive their payment under the Basic Payment Scheme as usual.

To be considered for the pilot, farmers must make an expression of interest, either via the Rural Payments Agency’s online system or a paper form. Those selected for the pilot will be informed in June 2021 and invited to submit an application. Applications will be processed during the summer with the first agreements going live in October.

If you would like to discuss the pilot further or make an expression of interest, please contact Andrew Jenkinson on 01280 818905 or email abrj@robinsonandhall.co.uk or Polly Sewell on 01234 362933 or email pkts@robinsonandhall.co.uk.

The Countryside Stewardship Capital Grants Scheme opened on 9th February 2021 and combines the Water Quality grant with the Hedgerows and Boundaries grants with a much wider range of options.

It is a two year grant directed towards capital works in three categories, these being boundaries, trees and orchards; water quality and air quality. The primary aim of the grant is to deliver environmental benefits across these three areas and allows those not in Countryside Stewardship Mid Tier or under a wildlife offer to access capital grants. In addition, if you are in Countryside Stewardship but you did not include all your fields and farm buildings, you may still be eligible.

There are 67 capital items available in the scheme including sheep fencing next to environmental features, and the total amount of funding has been increased from £10,000 to £60,000, although there is a limit of £20,000 per category.

Some items will need approval from a Catchment Sensitive Farming Officer (CSFO) before an application can be submitted which need to be applied for by the 19th March. These items are as follows:

| Code | Item |

| RP4 | Livestock and machinery hardcore tracks |

| RP13 | Yard – underground drainage pipework |

| RP14 | Yard inspection pit |

| RP15 | Concrete yard renewal |

| RP17 | Storage tanks underground |

| RP18 | Above ground tanks |

| RP19 | First flush rainwater diverters and downpipe filters |

| RP20 | Relocation of sheep dips and pens |

| RP21 | Relocation of sheep pens only |

| RP22 | Sheep dip drainage aprons and sumps |

| RP23 | Installation of livestock drinking troughs (in draining pens for freshly dipped sheep) |

| RP24 | Lined biobed plus pesticide loading and washdown area |

| RP25 | Lined biobed with existing washdown area |

| RP27 | Sprayer or applicator load and washdown area |

| RP28 | Roofing (sprayer washdown area, manure storage area, livestock gathering area, slurry stores, silage stores) |

| RP29 | Self-supporting covers for slurry and anaerobic digestate stores |

| RP30 | Floating covers for slurry and anaerobic digestate stores |

| AQ1 | Automatic slurry scraper |

| AQ2 | Low ammonia emission flooring for livestock buildings |

| TE4 | Supply and plant a tree |

| TE5 | Supplement for use of individual tree-shelters |

Applications for the Capital Grants Scheme must be submitted by midnight on 30th April 2021 and can be submitted in conjunction with a Mid Tier Wildlife Offer, or as a standalone application.

For more information or to find out how our Rural Property & Business department can help you please contact Katie Cross, Apprentice Rural Surveyor on 01234 362935 or email krc@robinsonandhall.co.uk

The land market throughout 2020 was subject to a number of unusual external factors, the main one being COVID 19, although BREXIT has also had an impact. This has consequently led to the supply of farmland across the United Kingdom reaching a record low. However, farmland values remained strong with good levels of demand, showing that confidence remains within the rural market in our area.

Instructed on almost 50% of publicly marketed farmland!

Robinson & Hall had a successful year in 2020 selling rural property and were instructed on almost 50% of the publicly marketed farmland in Bedfordshire and Buckinghamshire. Interest levels have been strong with sales up to 20% above the guide price achieved. Landowners looking to use rollover relief to avoid Capital Gains Tax has been a continuing theme for purchasers and, with major institutions looking to purchase land within the Oxford to Cambridge Arc, land prices have not dropped unlike other parts of the country. With the changes published in November 2020 on agricultural support through to 2024 it will be interesting to see how this affects the market, although agricultural profitability and land prices have not always been linked.

We purchase land for clients too

As well as offering property for sale, we often have clients looking to purchase land. Already in 2021, we are looking for a number of properties within the local area for private purchase ranging from 15 to 2,000 acres.

What you need to consider when selling your property

When looking to sell any property you have a range of options so it is important to speak to a local expert on what may best achieve your objectives. Some of our clients have been taking the opportunity to sell off small parcels of land through our property auctions at figures significantly in excess of agricultural values allowing projects or other changes to the business to be undertaken without taking on debt. Further details can be found here.

If you have rural property you are considering selling in 2021 and would like to discuss the multitude of options available to you, please contact one of our Rural Property team who would be happy to assist.

We have been eagerly awaiting the latest information from Defra on changes to agricultural policy following Brexit and our withdrawal from the Common Agricultural Policy. On 30th November we received the England’s Agricultural Transition Plan which sets out Defra’s future plans.

The Plan covers the following:

Reductions to the Basic Payment Scheme (BPS)

We have previously reported Defra’s plans to phase out direct payments by 2028 but we only had details of the reductions which would be applied to BPS in 2021. We now have the reductions up to 2024 which will be as follows:

| Payment | Reduction 2021 | Reduction 2022 | Reduction 2023 | Reduction 2024 |

| Up to £30,000 | 5% | 20% | 35% | 50% |

| £30,000 – £50,000 | 10% | 25% | 40% | 55% |

| £50,000 – £150,000 | 20% | 35% | 50% | 65% |

| Over £150,000 | 25% | 40% | 55% | 70% |

These reductions work in bands so if you receive a payment of £40,000 in 2020, in 2021 you would receive a 5% reduction on the first £30,000 and 10% on the remaining £10,000, leaving a payment of £37,500.

Beyond 2024 Defra intends to de-link the payment so that claimants no longer need to farm land in order to claim. The payment is likely to be based on a reference year(s). It is also intended that farmers looking to retire may be able to opt to take a lump sum payment in 2022 or 2023. Both of these elements will be subject to consultation in 2021.

Environmental Land Management (ELMs)

As a replacement to the current Environmental Stewardship (ES) the new scheme is intended to have three components:

The full options for ELMs are not expected to be in place until later in 2024 and therefore until then Defra will continue to offer new Countryside Stewardship Schemes and extensions to existing agreements.

Productivity Schemes

Similarly to the existing Countryside Productivity Small Grant and Growth Programme Grants it is intended to offer grants for investment as follows:

There will also be grants available for investment in slurry storage, animal health and welfare, new entrants, and support organisations to offer advice to farmers to work through the transition period.

The aim is to enable farmers to improve their productivity to allow them to farm without subsidy when direct payments are phased out at the end of 2027.

Regulation

Defra is keen to highlight its desire to move away from the current system of enforcement by penalty to more of an advisory role. Inspections will be more targeted to high risk areas and activities and penalties applied proportionately according to risk.

Overall we are yet to see detail of the payment rates which will be offered under the new ELMs and it is likely that the success or failure of the schemes, in terms of uptake, will very much depend on this. However, it is good that we are now getting some clarity on Defra’s thinking to enable farming businesses to plan for the future with the twin focus of environmental improvement and increasing farm productivity.

If you require any further information or would like to discuss your specific circumstances, please contact Andrew Jenkinson, Partner & Rural Surveyor on 01280 818905 / 07967 964508 or email abrj@robinsonandhall.co.uk or Polly Sewell, Partner & Rural Surveyor on 01234 362933 / 07771 774749 or email pkts@robinsonandhall.co.uk