Category: Rural Property & Business

Land and Property Professionals

We sell, rent, manage, survey, plan and advise...what can we do for you?

We sell, rent, manage, survey, plan and advise...what can we do for you?

The Department for Environment, Food and Rural Affairs (DEFRA) has launched a new Rural England Prosperity Fund (REPF), which offers grants to fund capital projects for small businesses and community infrastructure. The grant is worth £110 million and runs alongside existing DEFRA schemes, such as the Farming Investment Fund to acknowledge and assist with the specific challenges that rural areas often face.

The funding has been allocated to eligible local authorities and will be available from April 2023 to March 2025. The funding must be spent on capital projects in rural areas (i.e. buildings or equipment) for business or community purposes, in order to improve rural productivity.

For the purposes of the grant, a rural area is defined as:

1. Towns, villages and hamlets with populations below 10,000 and the wider countryside

2. Market or ‘hub’ towns with populations of up to 30,000 that serve their surrounding rural areas as centres of employment and in providing services

Example projects which could be funded include food processing equipment, converting farm buildings to other uses or rural tourism diversification such as event venues.

Some of the indicative local authority allocations are detailed below:

| Local Authority | Allocation |

| Bedford | £552,352 |

| Buckinghamshire | £1,828,695 |

| Central Bedfordshire | £1,061,854 |

| North Northamptonshire | £1,161,812 |

| West Northamptonshire | £1,367,953 |

The REPF submission window will be open from 3rd October to 30th November 2022, with the date of approval for funding proposals expected to be in January 2023. The REPF will start supporting investments from 1st April 2023 and the local authorities must allocate all funding by 31st March 2025.

A link to the REPF prospectus, which provides further details can be found here.

For more information or to find out how our Rural Property & Business department can help you please contact 01234 352201 or 01280 428010 or email bedford@robinsonandhall.co.uk

The Rural Payments Agency recently published guidance for farmers and land managers facing difficulties with meeting scheme requirements due to the extreme heat.

Since then, the Department for Environment, Food and Rural Affairs (DEFRA) has now approved temporary adjustments to some Countryside Stewardship and Environmental Stewardship options to assist farmers and land managers with the weather-related challenges that they are facing this year.

An agreement holder can decide whether to continue with the existing scheme options or whether to use the options with adjustments. The adjustments will apply from 17th August through to 31st December 2022, with all options returning to their original requirements from 1st January 2023 (unless otherwise stated).

Details of the options adjustments which have been approved by DEFRA can be found here.

For example, under the Countryside Stewardship option AB8 (Flower rich margins and plots), the temporary adjustment allows an agreement holder to cut or graze 100% of the area included in the option from 17th August to 31st October, in comparison to the usual requirement under this option, which is to cut or graze 90% of the area.

The adjustments have been made in order to relieve shortages of bedding, fodder, grazing or forage crops. However, it is important to note that regulatory and cross compliance requirements must continue to be met, and soil conditions must be considered.

To take advantage of the adjustments, an agreement holder must fill in the temporary requirement adjustments form, which can be found through this link here.

The form does not need to be returned to the Rural Payments Agency. However, the Rural Payments Agency can request to see the form at any time and therefore it must be kept for any future inspections. Additionally, the following records will need to be kept and produced if requested:

For more information or to find out how our Rural Property & Business department can help you, please contact 01234 352201 or 01280 428010 or email bedford@robinsonandhall.co.uk

Applications for the Sustainable Farming Incentive (SFI) scheme are now open. There is no deadline for applications, which can be submitted online though the Rural Payment Agency’s system. Payments will be made quarterly with the first payment usually made 3 months after the agreement start date.

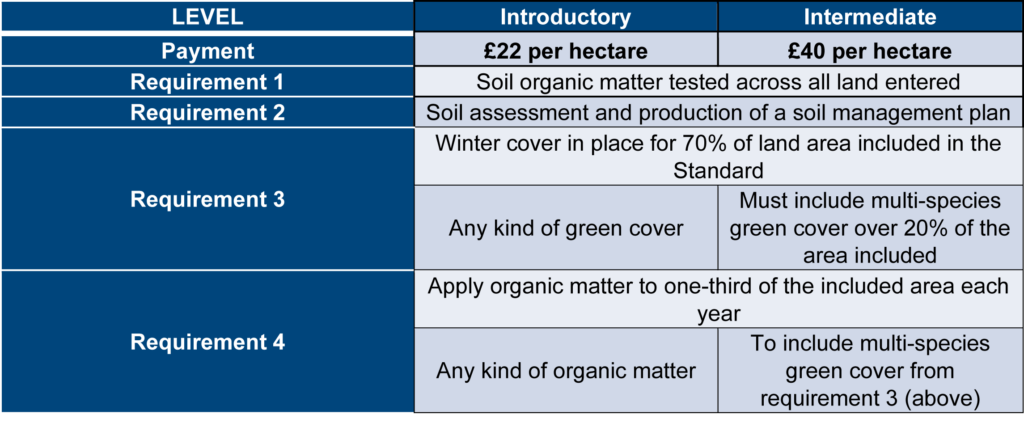

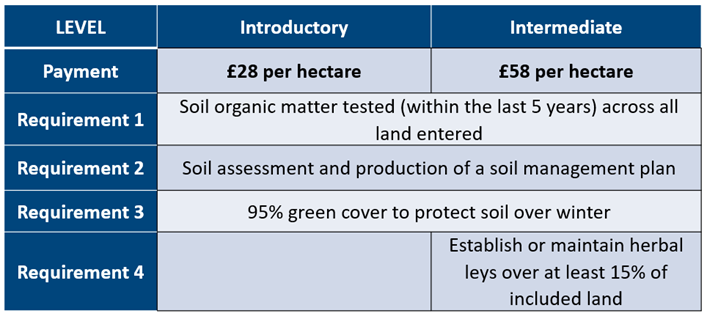

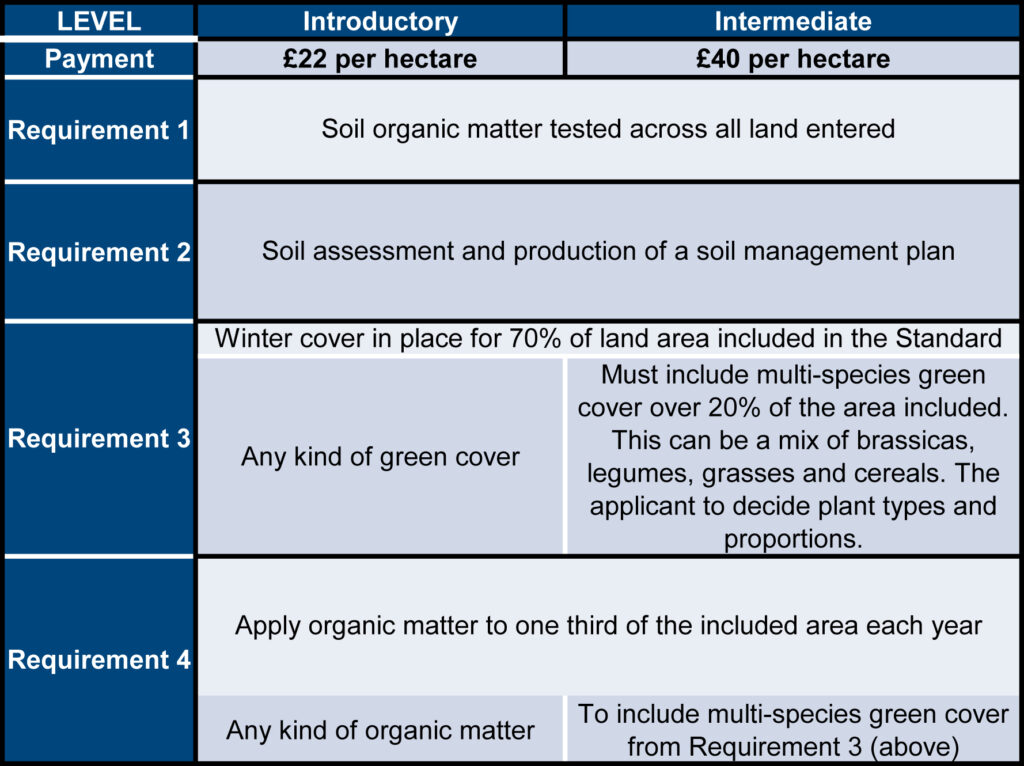

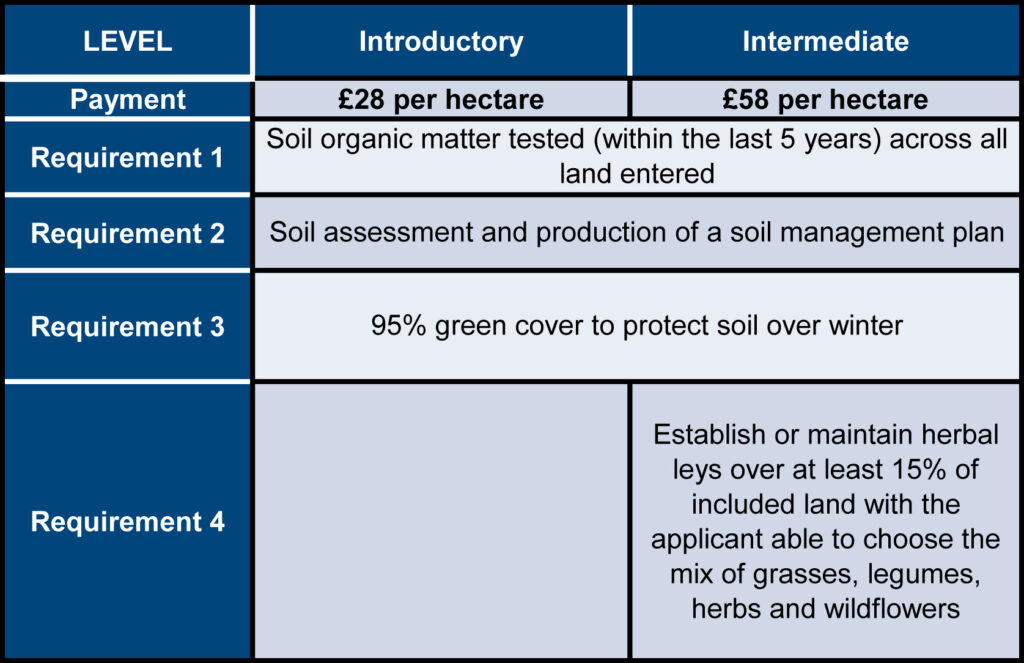

Currently there are only two standards available but more will be available in future years. The standards available, as well as the payment rates, are detailed below:

Arable and Horticultural Soils Standard

Key Points:

To be eligible for this standard, each land parcel entered must be cultivated arable land. This can also include temporary grassland, i.e. land that has been in grass or other herbaceous forage for less than 5 years. Alternatively, temporary grass can be entered into the Improved Grassland Soils Standard. If the temporary grass will have been down for more than 5 years at some point during the 3 year SFI scheme, it will need to be entered in the Improved Grassland Soils Standard as it would no longer be considered arable land.

Improved Grassland Soils Standard

Key Points:

To qualify as ‘improved grassland’, the land must have been managed in some of the following ways:

The detailed scheme requirements can be found here.

For more information or to find out how our Rural Property & Business department can help you please contact 01234 352201 or 01280 428010 or email bedford@robinsonandhall.co.uk.

Why diversify?

The phasing out of payments under the Basic Payment Scheme has resulted in many farmers looking for ways to protect their business income for future generations.

Through the re-use of redundant/surplus buildings or land of low productivity, diversification can open new sources of revenue that does not rely on the day-to-day agricultural enterprise, add value to assets, provide a new challenge, create new jobs and allow new business entrants in the form of younger generations/family members.

Farm diversification can come in many forms such as:

One of the first steps when considering a farm diversification project should be to assess the planning options available and, if necessary, prepare a planning strategy.

Many proposals utilising existing agricultural buildings may fall under Permitted Development Rights (PDR). Therefore, it is important to understand at an early stage in the project whether full planning permission for change of use is required or whether PDR can be used.

When you can use Permitted Development Rights:

Part 3 of The Town and Country Planning (General Permitted Development) (England) Order focusses on changes of use and in particular Classes Q, R and S focus on the change of use of agricultural buildings.

Class Q enables the conversion of agricultural buildings to up to five new dwellings, the floor space is limited at 465 sqm and the structure of the building must be confirmed as capable for conversion. You also must be able to evidence that the building was previously used for agriculture on or before 20th March 2013.

Class R enables the conversion of agricultural buildings to a flexible commercial use up to 500 sqm and the building must have been last used for agriculture on or before 3rd July 2012.

Class S enables the conversion of agricultural buildings to state-funded schools or registered nurseries providing the building was used for agriculture on or before 20th March 2013 and the change of use does not exceed 500 sqm.

The benefit of being able to use PDR to diversify is it is a simpler, quicker and cheaper way to get farm development through the planning system.

Other factors to consider:

Many sites that offer farm diversification opportunities are located within the open countryside, where planning permission for new buildings is contrary to policy and difficult to obtain. In addition, if a site is located within the Green Belt, a conservation area, a national park or an Area of Outstanding Natural Beauty, it is further restricted by the National Planning Policy Framework (NPPF) and various measures shall need to be taken to ensure the development is acceptable.

Liaising with the local planning authority:

Where PDR is not an option, it is beneficial to engage with the Council at the earliest opportunity and discuss your proposals at a pre-application stage. It is also helpful to engage with your local Parish Council and adjoining landowners and neighbours to gain support and address any concerns prior to the submission of an application.

Often, planning officers are not familiar with the day-to-day running of a farm and how agricultural businesses work. It can be helpful to your application to invite officers to gain an understanding of the enterprise when undertaking their site visit or to submit additional explanatory information as part of an application submission.

Key points to remember:

We have years of experience successfully helping farmers to diversify their farm business. We can help from start to finish and guide you through the process.

For further information or to find out how we can help you, please contact Shannon Fuller.

The industrial and storage market has seen the largest growth in property rents and has remained the most robust of the commercial property sectors. Over recent years, there has been a growth in online sales following the onset of coronavirus and both retailers and distributors are requiring an increased amount of storage space to facilitate these requirements.

Are my farm buildings suitable?

When considering whether commercial industrial property diversification is an option for you, there are a number of matters you should take into consideration, which include:-

The benefits compared to other diversification options:

When considering whether your farm buildings are suitable, you could also consider storage containers. These have also increased in demand and may be a smaller initial step into the commercial market.

For more information or to discuss your farm buildings and their suitability, please contact Tessa.

Whilst we’ve just completed the Basic Payment Scheme (BPS) and Countryside Stewardship Scheme annual claims for 2022, at the forefront of our rural team’s mind is the future of these schemes and those that will replace them. The guaranteed income from BPS is something farmers have come to rely on, especially at times of volatility in agricultural markets such as we are seeing now.

BPS will be phased out by 2028, with 2027 being the last year a payment is received under the scheme. By 2024, the payment will be around half of what claimants received in 2020 and therefore planning for this reduction in income is now vital.

The Lump Sum Exit Scheme, the Department for Environment Food & Rural Affairs’ (DEFRA) retirement scheme, is not an option for most but will be useful for a few farmers.

The Countryside Stewardship Scheme offers good levels of payment, recently increased, and is a good way of securing a guaranteed income from poorer parts of the farm without the risks of weather, price volatility, etc. Applications for agreements to start on 1st January 2023 must be submitted by 29th July 2022. With the huge range of options, including capital items, it is worth considering the scheme well in advance of this date to ensure applications are ready for submission by the deadline.

We now have more information of the Government’s much publicised Sustainable Farming Incentive (SFI), the first part of the new Environmental Land Management Scheme (ELMS). In 2022, the scheme will open in June with the Soils Standards for arable, horticultural and improved grassland. We are gradually getting the information on the scheme from DEFRA and the boxes below show the confirmed requirements so far.

Arable and Horticultural Soils Standard

Improved Grassland Soils Standard

Further standards under SFI will be launched in 2023-2025 including payments for hedges, woodland and biodiversity.

A further payment available under ELMS will be the Animal Health and Welfare Review. This is a contribution towards an annual vet visit. It is available to those with at least 50 pigs, 20 sheep or 10 cattle and the payments are as follows:

There is also funding available for capital items, with the Countryside Stewardship: Capital Grants Scheme. Applications are open now and will remain open until all the funding is allocated. This scheme pays a set rate towards capital items under three categories:

Claims can be made for capital items up to £20,000 for each category, £60,000 overall. There will also be further rounds of the Farming Equipment and Technology Fund and the Farming Transformation Fund.

A number of the above schemes are time limited and therefore it will be important for farmers to consider which schemes work best for their farms and act swiftly where funding is available. Making a start with the SFI Soils Standard will put people in a good position to enter the further standards when they become available as part of the paperwork will already have been completed.

For information or assistance on any of the above schemes, please contact Polly Sewell.

The Department for Environment, Food and Rural Affairs (DEFRA) has announced further details regarding the plans to replace the Basic Payment Scheme (BPS) in England with delinked payments. Currently, there is a defined plan for the phasing out of BPS payments to 2024, at which point the payments made to farmers will be approximately half of the payment received prior to phasing out.

The delinked payments, from 2024 to 2027, will be calculated on the average of the BPS payments made to a business in a reference period, 2020-2022, and then reduced based on the size of the claim as they are gradually phased out with the last payment made in 2027.

The delinked payments will not be affected by changes in farm size, nor if the land use of the holding is changed after BPS 2022. Following BPS 2023, entitlements will be cancelled to a nil value.

If there have been changes to a business since the start of the reference period (being BPS 2020), this could affect the amount of the delinked payment received.

Lump Sum Exit Scheme

The Lump Sum Exit Scheme (LSES) will provide BPS applicants who wish to leave farming with an opportunity to do so in a planned way. The scheme makes an up-front payment of a farmer’s future BPS payments so long as they surrender their entitlements and transfer out their land.

In order to be eligible for the scheme, applicants must have either:

In order to receive the lump sum payment, applicants must apply this year and then by 31st May 2024 must:

Applicants will still be able to work as a contractor or work for other farmers once they have received the lump sum payment.

A sole trader cannot transfer land to a spouse/civil partner, or to someone with whom they are cohabiting as a couple.

If a farmer decides to take the lump sum payment, they will no longer be eligible for BPS payments or delinked payments. Similarly, it is unlikely that a farmer will be able to meet the rules of other schemes, such as Countryside Stewardship or Sustainable Farming Incentive, if they have taken the lump sum payment.

The LSES reference amount is calculated by the average of a business’s BPS payments received in 2019, 2020 and 2021. This amount is then multiplied by 2.35 and this will be the lump sum available for each business. The reference amount will be capped at £42,500 meaning a total cap on the LSES payment of just under £100,000.

LSES applications will be open from April to September 2022. This is a one-off, non-competitive scheme, and all applicants must transfer out their agricultural land and provide evidence of this by 31st May 2024. If applicants wish to enter their agricultural land into woodland creation schemes instead of transferring it, they must be accepted into the scheme and have planted the trees by 31st May 2024.

There are a number of considerations for a business thinking about taking the LSES and therefore we would encourage people who feel it could be of interest to consider the scheme early as the application window is relatively short.

For more information or to find out how our Rural Property & Business department can help you please contact 01234 352201 or 01280 428010 or email bedford@robinsonandhall.co.uk

The Farming Investment Fund is an umbrella fund which provides farmers with grants to improve productivity on their farms in an environmentally sustainable manner.

The Department for Environment Food & Rural Affairs (DEFRA) has announced that the application window for the Improving Farm Productivity section of the Farming Investment Fund opened on 19th January 2022 and farmers will be able to apply for grants under this scheme until 16th March 2022.

This round of funding has a budget of £25 million with the main objectives being to boost farm production, as well as increasing farm and horticultural productivity.

DEFRA is offering grants of up to 40% of the costs for slurry treatment equipment, as well as robotics and innovation equipment which will reduce environmental impacts and improve efficiency on farm. The minimum grant available is £35,000 (40% of £87,500) with the maximum amount being £500,000.

Slurry treatment equipment

The grant can pay towards the costs of:

Robotics and innovation equipment

The grant can pay towards the costs of:

Further details of eligible items under the fund can be found here.

For more information or to find out how our Rural Property & Business department can help you, please contact 01234 352201 or email bedford@robinsonandhall.co.uk

Further details on the next stages of the implementation of the Environmental Land Management Schemes (ELMS) have been outlined by George Eustice at the Oxford Farming Conference.

The Local Nature Recovery Scheme and Landscape Recovery Scheme are set to work alongside the already publicised Sustainable Farming Incentive within the ELMS framework. The two new schemes will focus on the restoration of habitats and landscapes, a reduction in water and air pollution, and a drive for sustainable food production; the overarching aim being to ‘make more space for nature’.

The Local Nature Recovery Scheme (LNR) is set to introduce change at a farm scale. The scheme is to evolve from Countryside Stewardship, taking the ‘best’ points from Mid-Tier agreements and encouraging specific actions previously seen under Higher-Tier or Higher Level Stewardship agreements. Proposed options centre on the management, restoration and creation of different habitats in the farmed landscape. These include breeding areas for wildlife, species-rich grasslands and lowland heathland.

The Landscape Recovery Scheme (LR) takes the above and expands it to the landscape scale. For this, individuals or groups of interested parties (e.g. farmers, public bodies, estates) are to work together to deliver long-term projects, with individual projects to be 500 – 5,000 hectares in size. These will result in land use change and habitat restoration. The scheme is to be implemented in two rounds, with the first round for 15 pilot projects to be opened shortly. This round shall focus on the themes of recovering and restoring threatened native species, and restoring rivers and streams. This scheme is a long-term, collaborative commitment with projects scored against feasibility, cost and impact.

Unfortunately, more detailed information of the above schemes has not been circulated. We do know that the application window for the Landscape Recovery Scheme is due to open shortly, whilst the Local Nature Recovery Scheme is to be piloted in 2023, with full rollout not expected until 2024. Significantly, no indication of payment rates has been provided. Detailed rules are to be supplied by the Government in due course, once further reviews of proposals have been undertaken.

The three schemes within ELMS have been designed to be complementary to one another. Farmers will be able to choose which schemes they enter and we have been assured that there is flexibility throughout, allowing changes to the land included and timings.

Information on the schemes can be found at:

Local Nature Recovery: more information on how the scheme will work – GOV.UK (www.gov.uk)

Landscape Recovery: more information on how the scheme will work – GOV.UK (www.gov.uk)

For more information or to find out how our Rural Property & Business department can help you, please contact 01234 352201 or email bedford@robinsonandhall.co.uk

The Rural Payments Agency has recently announced changes to the Countryside Stewardship Scheme payment rates, effective from 1st January 2022.

If you have an agreement, or an application for an agreement which starts on or before 1st January 2022 then where the payment rate has:

For new agreements starting from 1st January 2023, all the new payment rates will apply.

The main payment rate changes are as detailed below:

| Revenue Option | Revenue Option Title | Old Rate (£) | Rate for agreements starting on or before 1st Jan 2022 (£) | Rate for agreements starting on or after 1st Jan 2023 (£) |

| AB1 | Nectar flower mix | 511 | 579 | 579 |

| AB2 | Basic overwinter stubble | 84 | 84 | 58 |

| AB6 | Enhanced overwinter stubble | 436 | 493 | 493 |

| AB8 | Flower rich margins and plots | 539 | 628 | 628 |

| AB9 | Winter bird food | 640 | 640 | 640 |

| AB12 | Supplementary winter feeding for farmland birds | 632 | 657 | 657 |

| AB15 | Two year sown legume fallow | 522 | 569 | 569 |

| BE3 | Management of hedgerows | 8 | 9 | 9 |

| GS2 | Permanent grassland with very low inputs (outside SDAs) | 95 | 132 | 132 |

| GS4 | Legume and herb-rich swards | 309 | 358 | 358 |

| HS2 | Take historic and archaeological features currently on cultivated land out of cultivation | 425 | 459 | 459 |

| SW1 | 4 – 6m buffer strip on cultivated land | 353 | 419 | 419 |

| SW4 | 12 – 24m watercourse buffer strip on cultivated land | 512 | 578 | 578 |

The full list of changes can be found here.

There are no plans for the payment rates for capital items to be changed.

For more information or to find out how our Rural Property & Business department can help you, please contact 01234 352201 or email bedford@robinsonandhall.co.uk