Category: Farm & Land Sales

Land and Property Professionals

We sell, rent, manage, survey, plan and advise...what can we do for you?

We sell, rent, manage, survey, plan and advise...what can we do for you?

2025 seems markedly different to 2024. The incessant rain of the last two years continued into the spring… then halted abruptly, seemingly never to return. Where there were puddles, there is now dust. Crops drilled into sodden ground are dying on their feet from a lack of water and the grass has not grown. It will be an early harvest, hopefully with low drying costs, but yields will be unremarkable. Straw and fodder will be in short supply.

High input prices and low commodity prices persist (although strong livestock prices continue), and of course the industry is still coming to terms with the inheritance tax changes, which may or may not bring a few holdings to the market.

There has been a modest but noticeable increase in the amount of land which has come forward this year (the Farmers Weekly estimates this as a rise of 14% over 2024). This is hardly a flood, but mobile buyers certainly have more choice.

So how has this news affected the agricultural land market? Surely, diminished profitability, increased supply and unwelcome tax changes must cause prices to drop?

Certainly, guide prices appear to be set slightly more cautiously this year. Agents and landowners are perhaps keen to get any sale off to a good start.

However, sale prices do not seem to have fallen noticeably. Decent arable land continues to make something in excess of £10,000/acre, with £12,000/acre not uncommon. Perhaps some of the higher outlying prices from last year, where there was local competition, has calmed down, but it really isn’t very different to 2024.

How can this be so?

Most importantly, the increase in supply is modest compared to the backlog of unsatisfied demand from last year. We do not see that the tax changes have brought that much land forward, yet at least, perhaps because farmland still holds tax advantages over other investments. The supply of rollover buyers continues to be replenished, and larger units will attract interest from all over the country.

Of course, there are many regional variations. Some parts of the country have seen a number of farms come forward, while farms remain in short supply in other areas. The financial capacity of the local farming community is always a factor, and as usual I would expect to see a variation of several thousand pounds per acre for very similar land based solely upon that local demand. This is particularly the case for smaller blocks.

It is also a truism that farming is a long-term venture, with time horizons of decades or even generations. Farmers do not get too carried away by a few easy years, and likewise they are used to living with a few difficult years. If the right land comes up locally then it can be hard to ignore. When will the chance come again?

This season, we have offered Grange Farm, Weston Underwood in North Buckinghamshire, being a 356-acre arable farm with buildings and planning consent for a farmhouse. At the time of going to press, we have not exchanged contracts, but I can report that local bidding has taken the price beyond the guide of £4,000,000.

We are just launching to the market Halse Farm, Taunton, Somerset, being an 843-acre arable farm with farmhouse, holiday lets and farm buildings. The guide price for the whole is £10,180,000, and we shall see over the next week or two what interest is received. Even before going to the market, we have received approaches.

In summary, there is a little caution with a slightly increased supply of land, but the latent demand for farmland persists, and it seems that the market is not greatly changed from last year.

For more information or to discuss selling your land or farm with our agency team, please contact David.

Like a hole in the head, Rachel Reeves has revoked a 1992 inheritance tax exemption for farms, resulting in farmers having to pay 20% in tax over £1 million with effect from April next year.

If farmers weren’t struggling already to make ends meet, these taxation changes have led to landowners looking for means of raising capital, and what better way than the diversification of a farmyard or successful promotion of a paddock within or on the edge of a settlement.

Farmyard developments, whether that be the conversion of existing agricultural buildings or the replacement of these buildings with dwellings, can be a lucrative arrangement, especially if the barns are not suitable for modern farming machinery or they stand alone in the wrong place on the holding.

In terms of planning strategy, there are several options available including a pre-application enquiry, Permission in Principle (PiP) submission, or straight to an outline or full planning application. Depending on the objectives of the landowner, this will dictate the strategy. For example, are you looking to dispose of the barns or retain it? Do you wish to control the planning process and design due to living adjacent to the scheme? If so, you may wish to obtain full planning as opposed to allowing a developer to dictate the materials and final details of the design.

Alternatively, if you own a paddock in a village or on the edge of the settlement, given the Government has said there are ‘no excuses’ as to why it can’t deliver on its promise of 1.5 million homes by 2029, now is the time to consider its suitability for development. Planning can be an expensive risk, even for smaller schemes. This is where option and promotion arrangements have their place, allowing the financial risk to be passed to the developer partner. It is worth noting that landowners can do their bit to promote their land, and examples of this include ensuring the land is included in councils’ ‘call for sites’ processes, and making the village aware if they are undertaking a Neighbourhood Plan exercise. Should your land be allocated for development in either a Local Plan or Neighbourhood Plan, this can enhance the prospect of development and value significantly.

It is important that prior to unlocking value, landowners have considered matters such as taxation and farm planning, as you wouldn’t want poor forward thinking to erode the benefits of a successful development scheme.

Did you know that we also specialise in planning appeals?

We obtained Permission in Principle on appeal for residential development comprising a minimum of one and a maximum of four dwellings following a refusal by Huntingdonshire District Council.

The key points to take home are:

This appeal clarifies, what has been for a long time, an area of dispute between applicants and some councils since the PiP route was introduced in 2017. It is a route that landowners and developers can obtain formal confirmation from the Council on whether the principle of a proposed development is acceptable before spending huge amounts of money on matters of detail.

At Robinson & Hall, we can offer the client a complete suite of services, taking the site from the initial site visit, right the way through to disposal, with a range of services including planning, architectural drawings, building surveys and agency.

Should you have a parcel of land or a range of farm buildings which you think might be suitable for development, do not hesitate to contact me.

As the 2024 farmland market draws to a close, we might conclude that little has changed since 2023. Indeed, the statistics for the past few years have remained fairly consistent.

The total acreage offered for sale across the country has changed very little, although as always there are regional variations. We have perhaps seen more farms for sale in the eastern counties than for some time, while in the central counties, offerings have remained rather slim.

Accordingly, it is little surprise that prices have remained fairly consistent. There is very little arable land which has sold for less than £10,000 per acre, while some parcels have achieved £12,000 – £15,000 per acre, or even more where there is local competition.

Large complete farms have as usual been in short supply. Rollover buyers who have been unable to find a large farm in 2024 will no doubt be waiting anxiously to see what comes on the market early in 2025. However, the big news in 2024 is of course the recent Budget, and it will be interesting to see what effect this might have on the market next year.

Farming profits have been squeezed for a couple of years now with increased fuel and fertiliser prices and with challenging weather. Some sectors will feel the effects of national insurance and minimum wage changes more than others. The fruit and vegetable sector in particular will notice the difference.

Increased capital gains tax rates might give a greater urgency to rollover buyers, but the inheritance tax changes might decrease the demand from those looking to shelter their wealth in farmland, and it might increase the supply of farms to the market if retiring farmers are more encouraged to sell. That said, agricultural land will continue to be a better shield against inheritance tax than most other investments, even if the reliefs are not as good as we have been used to.

With falling interest rates, it seems unlikely that the banks will be pushing struggling farmers into a sale, so I don’t expect the supply of farms coming onto the market to change massively. Likewise, whatever the tax changes, there remains a strong underlying demand from farmers to acquire additional land locally.

No doubt we will see some changes in 2025 if the supply of land increases significantly, or if the demand falls significantly. Neither of these events is assured, but we shall be watching the market with interest.

Robinson & Hall has been the foremost regional agent for agricultural land in our area since 1882. Few sales take place in the region where we do not act for either the seller or the buyer, and our local knowledge is unrivalled. We also purchase many farms across the region and across the country for our expanding farmer client base.

For more information or to discuss selling or buying farm and land, please contact me.

2023 saw a continuation of strong competition for blocks of good farmland and, in particular, for larger complete farms. Unless there is a significant increase in supply of farms to the market, I do not expect this pattern to change in 2024.

The quantity of available farmland rose slightly in 2023 but still remains below historical level. With little pressure from the banks, it remains the instinct of many farmers and of their families to retain land if possible, even if responsibility for the day-to-day farming is given over to a contractor. The family can remain in the farmhouse and can enjoy the amenity of the farm. Diversification projects can be pursued. The taxation advantages of holding farmland have not been eroded. The status quo is appealing to many.

In the meantime, there is a continuous demand for farmland and for farms, both from those within the industry and from without. Landowners who have received a welcome windfall from development sales can quickly find themselves at the end of their 3-year rollover period, at which time sensitivity to the purchase price is dulled. Funds from outside agriculture, particularly for residential properties, is almost limitless.

Accordingly, we have seen that virtually all decent farmland achieved a minimum of around £10,000 per acre last year, but with local competition this price could be pushed to £12,000 per acre, £14,000 per acre or even higher on occasion.

For purchasers with many tens of millions of pounds to spend, of which there is no shortage, a residential farm of 1,000 acres or more is often the target. However, with only a couple of dozen such farms available every year, competition can be fierce.

As I write, the 2024 selling season is just beginning to get underway and we are beginning to see a few farms coming forward. At present, I see no sign that the supply will be much different to last year, and accordingly I would expect to see similar results. Smaller blocks of land will be subject to local competition, which can show a significant variation in prices dependent upon the appetite of the immediate neighbours. Larger blocks will attract interest from across the country, and the expectation is that prices will be in line with the prices which we have seen for the past few years.

At Robinson & Hall, we monitor all farmland sales across the region and larger sales further afield. We are happy to advise on all sales and purchases. Please contact David to discuss further.

Globally and nationally, we are in testing times. Interest rates, inflation and energy prices remain stubbornly high and certainly at levels which have not been seen for several decades. Labour costs also remain high, with shortages in most sectors. International tensions in Ukraine and now in Israel/Palestine provide further threats to our domestic security.

As a result, many sectors are struggling, including manufacturing, transport and leisure. House prices are falling, the value of investment properties is falling and the international property markets in many parts of the globe are suffering quite badly.

In domestic agriculture, we still have relatively high fuel and fertiliser prices together with a shortage of experienced farm labour and an extreme shortage of seasonal labour. Commodity prices generally are lower than a year ago and profits are feeling the pinch.

Nevertheless, despite all this gloom, farmland values continue to go from strength to strength. There is virtually no decent arable land selling for less than £10,000 per acre, and to see prices rise to £12,000, £14,000 and even £16,000 per acre where there is local demand is far from uncommon.

Significant blocks of grassland in the central and eastern counties might not be so keenly pursued, but complete farms of 500 acres or more have been in short supply. There remains considerable cash within the farming community from rollover funds, with farmers looking to relocate to their dream holding. Regrettably, the choice of such holdings has been limited and selling agents have had little difficulty in securing sales.

There continues to be significant funds available from outside the farming community as well. In difficult times, land is seen as a safe bet. With stock markets difficult to predict and with other property investments in decline, considerable money has been coming into the farmland market.

The number of unsatisfied buyers from the 2023 season is substantial and this can only mean increased demand in 2024. Without a significant increase in supply, which seems unlikely, I would predict that prices will either maintain their current levels or increase yet again in 2024. Generally speaking, farmers are not under pressure from their banks and I see no reason why there should be significantly more farms on the market next year.

Finally, I would highlight a phenomenon at the lower end of the market. Paddocks, small pieces of woodland, off-lying rundown buildings, old railway embankments and the like may hold no real value to a farmer. However, on the open market, these seemingly useless items can secure extraordinary prices if marketed correctly. We tend to put these properties through our regular property auction. The competitive environment of the sale room brings the best out in bidders, and the results can be extraordinary. Farming clients have been able to sell an asset which has no value to them but which enables them to pay off the overdraft, pay the school fees, erect a new grain store or upgrade the combine.

To conclude, agricultural land is often compared to gold. It provides a safe investment in difficult times. Where the demand is rising and the supply remains static, we can only see a strong market through 2024.

For more information or to discuss the opportunities available to you, please contact David.

Robinson & Hall’s core patch lies within one of the strongest areas in the country for residential development land activity.

Lying in the centre of the Oxford-Cambridge Arc, beyond the London Green Belt and with excellent access to the railway and motorway networks, this area is easily commutable to London with good connections to Birmingham and the north. It is no surprise that considerable residential development is focussed on the counties in which we operate. We have achieved many significant successes for our landowning clients, with every expectation that this will continue.

Clearly, the housing market has been tested since September of last year with increased interest rates on top of significantly increased energy, materials and labour prices. Nevertheless, during this time we have been able to conclude four major sales, all to housebuilders who need to maintain their presence in this all important region.

As we enter 2023, sales rates are climbing again and there is increased confidence that both inflation and interest rates will come under control. While there remains a degree of caution, a housebuilder needing to hold a presence within the Oxford-Cambridge Arc will not have many sites to pursue and good sites continue to sell well.

Sale prices per acre can vary considerably but we are still expecting most sales to achieve many hundreds of thousands of pounds per acre and even in excess of £1,000,000 per acre on occasion. We are also involved in zoning land for distribution warehousing where even higher prices per acre can be achieved for the correct location.

The journey for our landowning clients usually starts with a planning appraisal. We then offer the site to a small number of professional development promotion firms with whom we have strong contacts. A promoter can be engaged to manage and fund the promotion process, usually over many years, in return for a share of the development proceeds. We oversee this process on behalf of the landowner, acting as the liaison between landowner and promoter.

Releasing land for residential development can be extremely rewarding but the pitfalls are many. It is important to assemble a strong, experienced team if a positive result is to be achieved.

For more information please contact Hugo Bryan, Assistant Development Surveyor on 01234 362894 or email hjgb@robinsonandhall.co.uk

When it comes to land that sells for development, it may appear that some landowners are just lucky but that is not the case; such landowners have made their own luck! Turning farmland into a potential housing development happens by actively and successfully promoting the land (usually over several years). If a landowner is not trying to promote the land or working with third parties to do so, they have little to no chance of success.

Is now the right time to promote my land for development and what’s the current development market like?

It is no secret that the development land prices have dropped from the 2022 peak (prior to Liz Truss’s mini budget in October 2022). A few examples of issues that housebuilders and purchasers are contending with are:

On the flip side, development land prices continue to benefit from a limited supply of good development sites available on the market and in turn, limiting the current reduction in sales prices. Looking forward, it is predicted that the inflation rate will slow to around 5% by the end of the year, which will also benefit the sector.

Development sites often take many years to promote and a few years to construct. Therefore, there is ample time for the market to recover for a development scheme that begins the promotion process today. In addition, a net minimum sale price (per acre) can and should be put in place to protect the landowner. Our knowledge of strategic development sales is invaluable in the sales process to ensure that the best price can be achieved given the current market circumstance.

What are my promotion options?

Promotion Agreement

A promotion agreement is a legally binding contract between the landowner and a land promoter. The promotion agreement is created to bind the parties to work together in achieving a desirable planning permission. The promoter funds the planning process entirely at their risk and if they are unsuccessful then the landowner has nothing to pay. However, if the promoter is successful then the land is marketed, a proportion is paid over to the promoter and the remainder is available for the landowner. There are of course many other important terms within a promotion agreement to protect the landowner which would need to be carefully negotiated. The correct land promoter will bring with them experience and expertise that is invaluable to achieving the desired outcome.

Option Agreement

An option agreement is a legally binding contract between the landowner and a developer. The option agreement grants the developer the right to purchase the land from the landowner during an option period in return for an option fee. The developer may look to gain planning on the land during the period. The purchase price the developer will need to pay the landowner will be pre-agreed within the option agreement. The price could be a fixed price or a discounted percentage from the agreed market value of the site at the point of sale. The right to exercise the option lies with the developer.

Self-Promotion

Land can be promoted by the landowner, usually with the help of an agent and other third parties. The landowner will look to fund the promotion of their land themselves, the benefit being that if their promotion is successful, the landowner will keep a higher amount of the proceeds. It is usually more viable for a landowner to promote their land on a smaller scheme.

How can we help?

Robinson & Hall, acting as land promoter, has promoted smaller sites for clients and the costs for the promotion are shared between Robinson & Hall and the landowner. We would take a pre-agreed percentage of the final sale if the promotion was successful, similar to any other promoter.

Robinson & Hall can increase your odds

We act for the landowner, not the promoter, to achieve the most favourable terms. Factors that are often negotiated include the upfront payment to the landowner, the length of the term of the agreement and the percentage split of the proceeds.

Robinson & Hall has a preferred list of promoters who we approach on behalf of our clients and who have a track record of successfully promoting sites for development.

From instruction to the point of sale, we will be working on behalf of the landowner to achieve the best results.

If you are considering your options and would like to find out how we can help you, then please contact David Jones, Partner at Robinson & Hall, on 01234 362906 or Hugo Bryan, Assistant Development Surveyor at Robinson & Hall, on 01234 362894.

When approached by clients with potential development land, our first task is often to select a professional promoter to take the project forward. A land promotion can easily cost hundreds of thousands of pounds, even millions in some cases, and few landowners wish to risk such sums on an uncertain outcome. A promoter will take on the cost of the promotion at risk in exchange for a slice of the sales revenues if a consent can be achieved and the land sold.

But, which promoter to choose? There are hundreds claiming to be the next big thing, but few have both the experience and the finances to make it onto the Robinson & Hall shortlist. Negotiating good terms is an important part of our role but selecting the right partner to work with is arguably the most important decision of all. Much better to achieve a sale at more generous terms to the promoter than to choose the promoter offering the keenest terms only to find that they are unlikely to produce a positive result.

We work with the client’s solicitor and accountant (it is never too early to take tax advice in these matters) to produce a promotion agreement and it is then for the promoter to survey the land, produce masterplans, make representations to all relevant bodies, woo local politicians and planning officers, deal with local objections, overcome technical issues and many other things besides. We remain close to the promoter throughout this period, reporting to the landowner and often having input into design and the handling of local politics. We monitor the many surveys which will be required (ecological, archaeological, landscape impact, highways, ground investigations and many more), ensuring the minimum disruption to farming activities and negotiating compensation where necessary.

Hopefully, usually after some years of input from the promoter and ourselves, we will eventually arrive at the happy day when a planning committee resolves to grant consent for the residential development of the land. Our work is just starting. There is a Section 106 agreement to be agreed and signed, the planning consent must be issued by the local authority and we begin preparations for a sale of the land. Often, we need to commission further work to clarify matters such as archaeology, contamination or ground conditions. We bring all the title, technical and planning documentation together into an online dataroom and we market the land to our database of national and local developers. Our work is not over until a sale contract is signed and it takes great experience to ensure that the best possible price is actually achieved for our landowner clients.

Over the past year or more, residential development land values have been assailed by higher materials prices, higher labour costs, increasing fuel costs, rising interest rates, political turmoil and the covid pandemic. Yet we have continued to achieve rising prices for our land sales. Part of this success comes from the continued strength in the housing market, but part lies in knowing which housebuilders are in greatest need of a new site in any particular area. Our local knowledge is invaluable.

No doubt there are new challenges to the market now upon us. How the market will react in the short term I cannot say at this time. However, in the longer term, the demand for new housing in this region must continue and the opportunities for careful landowners are obvious. Promoters are as keen as ever to secure good sites and the housebuilders know that they need to buy land if they are to continue to build houses.

If you are considering your options and would like to find out how we can help you, then please contact David or Andrew.

Robinson & Hall’s agency teams have in-depth knowledge of a range of property markets across the region.

The sector which has been most active for our teams this year has been the sale of residential development land. Our offices lie in the middle of the Oxford-Cambridge Arc which is a focus for new housebuilding. With easy commuting into London and good transport links to the remainder of the country and internationally, our region is an obvious area for the release of land for housing developments.

Of course, the competition to receive a coveted planning consent is fierce and nothing is won easily. Often sites have to be promoted for years or even decades before a success can be achieved and many will never make it despite the efforts and money which have been sunk into the project. It is a risky business and the development world is inhabited by every variety of shark. It is our job to steer our clients through this dangerous and ever-changing maze.

For more information please contact David Jones.

Agricultural Land

At this time of year, we look forward to the prospects for the agricultural land market. We would normally expect to see the first properties coming to the market by this time, but the big news is that there is very little available. This continues the theme of recent years when supply has been very tight with well-funded purchasers chasing the better farms and blocks of land which become available.

Some observers have predicted that much more land will come to the market this year as a result of the Agriculture Act, increased fuel prices, increased fertiliser prices and increased interest rates. Likewise, it is predicted that buyers will be in short supply for the same reason.

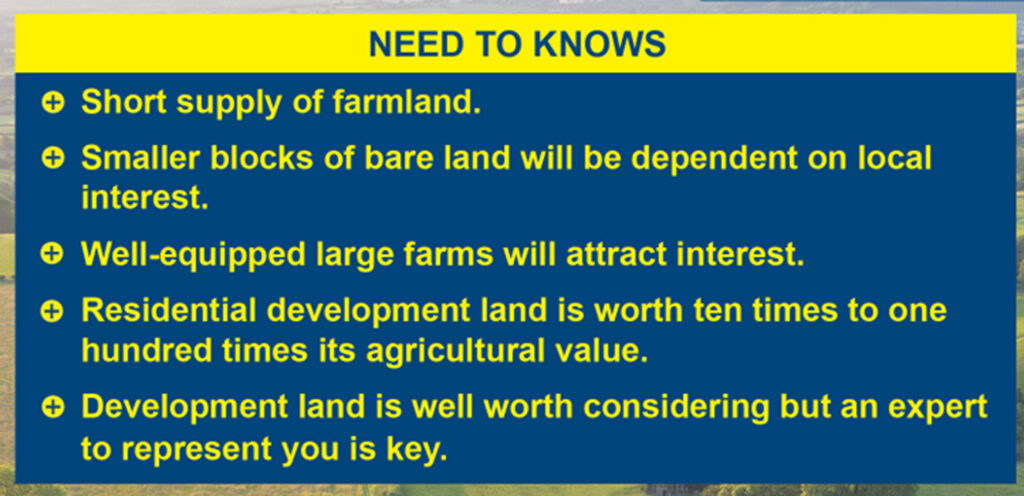

My own prediction is that we shall see little difference from last year. In reality, there is little pressure from the banks for farmers to sell. Meanwhile, there is a considerable number of well-funded buyers who are willing to compete for whatever is available. Smaller blocks of bare land will continue to be dependent upon local interest, which could give rise to a wide range of outcomes. Well-equipped large farms, whether commercial or residential, will certainly attract interest.

Residential Development Land

Many landowners dream of the possibility of releasing a few acres for residential development. We have certainly been able to assist many across the Oxford to Cambridge Arc and beyond, in converting farmland into residential development land worth a multiple of between ten times and one hundred times its agricultural value.

Such sales can be life-changing, often providing a broader range of opportunities for the next generation. However, a lot of time and money has to be invested to maximise potential. There is much to be won and much to be lost. Proceeding in the correct manner is key.

We work with a select list of professional promoters in securing Local Plan allocations with great success. We are always keen to manage the marketing of the land to ensure that best value is secured and also to deal with important matters such as retaining the correct rights to any retained land. The development world is full of sharks and egos and it is important to be well represented.

If you are considering your options and would like to find out how we can help you, then please contact David Jones.